December 2025 Monthly Report

Overview of supervised entities’ activities in the financial services sector for December 2025

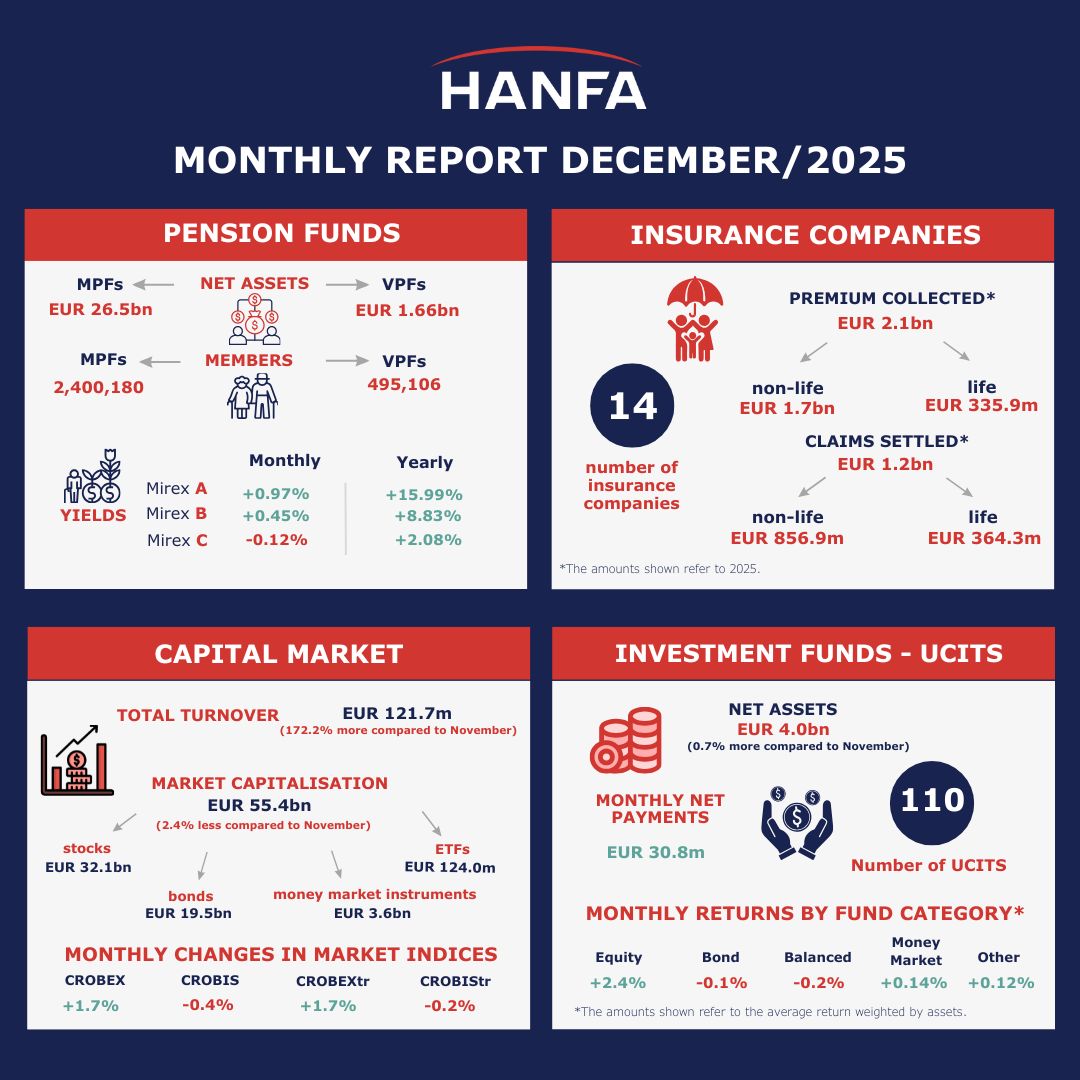

PENSION FUNDS

SECOND PILLAR PENSION FUNDS

At the end of December 2025, mandatory pension funds (MPFs) had 2,400,180 members, i.e., 3,882 (0.16%) members more than in the previous month. Category B funds had 74.84% of all MPF members, while category A and category C funds had 21.76% and 3.40% of all MPF members respectively. Out of 6,376 new members, 5,960 (93.5%) were automatically allocated by Regos. Termination of membership due to retirement or death was recorded with respect to 2,494 insured persons. Total net contributions paid to MPFs amounted to EUR 159.0m (0.6% of net assets at end-November). At the same time, total payments from all MPFs due to personal account closures reached EUR 55.8m (0.2% of net assets at end-November, rising by EUR 5.7m (11.4%) compared to the previous month.

At the end of December 2025, MPFs’ net assets amounted to EUR 26.5bn, which was EUR 207.2m (0.8%) more than in the preceding month, and EUR 3.2bn (13.9%) more at the annual level. Nominal monthly Mirex returns reached 0.97% for category A, 0.45% for category B and -0.12% for category C. Annual Mirex returns reached 15.99% for category A, 8.83% for category B and 2.08% for category C, while annualised[1] returns since the beginning of MPFs’ operation reached 8.44% for Mirex A, 5.54% for Mirex B and 3.25% for Mirex C[2]. At the end of December, MPFs’ bond investments totalled EUR 14.9bn (56.2% of total assets), making their share decrease by 0.58 p.p. on a monthly basis. The share of equity investments in MPFs’ assets slightly decreased (by 0.01 p.p. on a monthly basis), amounting to 24.4% of MPFs’ assets (EUR 6.5bn) at the end of December. Investments in domestic shares accounted for 14.0%, while investments in foreign shares accounted for 10.4% of MPFs’ assets. Investments in investment funds amounted to EUR 2.8bn (10.7% of the assets), making the proportion of these investments in total assets increase by 0.4 p.p. relative to the previous month. Cash and deposits amounted to 6.4% of the assets, or EUR 1.7bn, decreasing by 0.2 p.p. on a monthly basis.

THIRD PILLAR PENSION FUNDS

At the end of December 2025, the number of members of 8 open-ended voluntary pension funds (OVPFs) rose by 0.96% on a monthly basis, while the number of members of 21 closed-ended voluntary pension funds (CVPFs) increased by 0.67%, making the number of members of these funds reach 444,107 and 50,999 respectively. Total monthly payments made to voluntary pension funds (VPFs) in December 2025 amounted to EUR 48.9m (3.0% of net assets at end-November), increasing by 249.6% compared to the previous month. The reason for such large monthly change is the payment of government incentives, which are always paid in December. Total payments made from these funds reached EUR 5.7m, increasing by 25.6% on a monthly basis. Total payments from VPFs made due to retirement and other reasons accounted for 67.1%, payments made due to the change of fund reached 25.7%, while those made due to death accounted for 7.2% of total payments in December. As regards total payments made due to retirement, the amount of EUR 1.8m was paid through a pension company (fund), the amount of EUR 1.0m was paid in the form of lump-sum payments, while the amount of EUR 0.9m was transferred for payment to pension insurance companies.

In December, net assets of VPFs increased by EUR 49.1m (3.1% on a monthly basis) and stood at EUR 1.66bn. The increase on an annual basis amounted to EUR 213.5m (14.8%). Monthly nominal returns of VPFs ranged from -0.2% to 1.4%, while returns on an annual basis ranged from 1.6% to 16.0%. As regards the investment structure of VPFs, the largest part of the portfolio was made up of bonds and amounted to a 52.2% share in total net assets, followed by stocks with a 28.2% share and investment funds with a 9.7% share. The share of bonds in VPFs’ investments decreased on a monthly basis by 1.3 p.p., while the equity share increased (by 0.3 p.p.), as well as the share of investments in investment funds (also by 0.3 p.p.).

INSURANCE COMPANIES

In December 2025, there were 14 insurance companies operating on the market. The total premium collected in 2025 amounted to EUR 2.1bn, i.e., 7.5% more than in 2024. EUR 335.9m (16.2%) of this amount related to life insurance premium (0.2% more than in the previous year), while EUR 1.7bn (83.8%) related to non-life insurance premium (9.1% more at an annual level). The structure of the non-life insurance premium collected is dominated by motor vehicle liability insurance (35.2%), followed by insurance of road vehicles (19.7%), insurance against fire and natural disasters (9.3%) and health insurance (8.8%). The amount of claims settled in 2025 reached EUR 1.2bn, decreasing by 3.0% compared to 2024. EUR 364.3m (29.8%) of this amount related to life insurance (16.8% less at an annual level), while EUR 856.9m (70.2%) related to non-life insurance (4.3% more compared to the same period in 2024). In the total amount of claims settled in non-life insurance, the largest amounts related to motor vehicle liability insurance (39.9%), insurance of road vehicles (21.3%), health insurance (11.8%), and insurance against fire and natural disasters (7.9%).

CAPITAL MARKET

The total turnover on the Zagreb Stock Exchange reached EUR 121.7m in December 2025, increasing by 172.2% on a monthly basis. The total turnover in the entire 2025 reached EUR 865.8m, rising by 88.5% compared to 2024. Market capitalisation decreased by 2.4% relative to the previous month and stood at EUR 55.4bn, of which stocks amounted to EUR 32.1bn, bonds to EUR 19.5bn, money market instruments to EUR 3.6bn and ETFs to EUR 124m. As regards sectoral stock indices, the largest monthly growth (3.5%) was recorded by CROBEXtransport, while CROBEXturist recorded the largest monthly decline (-2.7%). The main ZSE stock index CROBEX recorded a monthly increase of 1.7%, as did CROBEXtr. On an annual basis, CROBEX recorded a growth of 20.9% in 2025, while CROBIS declined by 0.9% compared to end-2024. As regards bond indices, CROBIS recorded a monthly decrease of -0.4%, while CROBIStr decreased by 0.2% on a monthly basis. KONČAR d.d. was once again the stock most traded in December, with its turnover amounting to EUR 14.0m (35.1% of the overall trade in stocks in December) and a 7.0% monthly price increase. KONČAR d.d. was the stock most traded in 2025, with its turnover amounting to EUR 149.1m, and an annual price increase totalling 57.7%.

INVESTMENT FUNDS

At the end of December 2025, there were 110 UCITS operating on the market. Their total net assets amounted to EUR 4.0bn, increasing by EUR 80.4m (2.0%) compared to the previous month. Compared to end-2024, net assets of all UCITS rose by EUR 814.4m (25.2%). Total monthly net payments to UCITS in December were positive, amounting to EUR 30.8m. Positive net payments were recorded by money market funds (EUR 15.1m), equity funds (EUR 11.7m), funds categorised as “other” (EUR 11.0m) and balanced funds (EUR 3.1m), while negative net payments were recorded by feeder funds (EUR -1.4m) and bond funds (EUR -8.6m).

Money market funds’ net assets accounted for 35.4% of the total net assets of all UCITS at the end of December, bond funds made up 19.3%, funds categorised as “other” 15.8%, while balanced and feeder funds accounted for 18.7% and 2.3% of the total UCITS’ net assets respectively. Positive asset-weighted monthly returns were recorded by equity funds (2.4%), money market funds (0.14%), “other” funds (0.12%) and feeder funds (0.07%), whereas negative asset-weighted monthly returns were recorded by bond funds (-0.1%) and balanced funds (-0.2%).

The assets of the Fund for Croatian Homeland War Veterans and Members of their Families amounted to EUR 222.7m (a 1.2% monthly decrease), with the monthly return of the fund reaching -0.97%.

The full report is available at Statistics/Monthly reports.

[1]The annualised return is the geometric average of annual returns realised in the period observed.

[2] Beginning of operation: MPF category B: 30/4/2002; MPFs category A and C: 21/8/2014